IRS Extends Relaxation of Installment Agreement Rules through Sept 2018

October 10, 2017

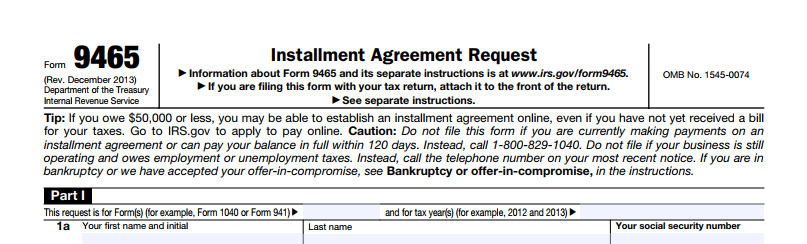

The IRS has both extended and expanded its trial streamlined installment agreement program through September of 2018.

According to the IRS, they are “testing whether the expansion of streamlined processing criteria to taxpayer installment agreement requests will improve customer service, reduce taxpayer burden and increase agency efficiency.”

NEW RULES FOR STREAMLINED INSTALLMENT AGREEMENTS

In their expanded test, the IRS seems is not requiring a collection information statement for streamlined installment agreements, and is giving the taxpayer more options to submit payments.

Liabilities of $25,000 – $50,000

A streamlined installment agreement for taxpayers with liabilities (including penalties and interest) of $25,000 – $50,000 no longer requires a collection information statement. Taxpayers are also no longer “required” to pay via direct debit payments or payroll deduction; however, it is “preferred”. Do note that while a direct debit or payroll deduction is no longer required, a Notice of Federal Tax Lien determination will be made if the if the taxpayer does not agree to direct debit or payroll deduction.

This also applies to non-operating businesses with debt amounts up to $25,000 and non-operating sole-proprietorships with debt amounts up to $50,000. For in-business taxpayers, the new rules only apply to debt amounts up to $25,000.

Liabilities of $50,000 – $100,000

Prior to the original installment agreement relaxation trial period, taxpayers with liabilities greater than $50,000 (including interest and penalties) were not eligible for a streamlined installment agreement. Beginning in October 2016, the IRS made streamlined installment agreements available for taxpayers with liabilities up to $100,000, and increased the payoff period by one year, now allowing 84 months to pay off the debt.

In the latest iteration of the trial program, taxpayers with liabilities between $50,001 and $100,000 are not only eligible for a streamlined installment agreement with a payment term of up to 84 months, but now no collection information statement is necessary as long as the taxpayer agrees to make payments by direct debit or payroll deduction. Regardless of which payment method the taxpayer chooses, a Notice of Federal Tax Lien determination will be made for liability amounts falling into this range.

If the taxpayer chooses to pay by means other than direct debit or payroll deduction, then a Collection Information Statement will be necessary.

This also applies to all non-operating business and non-operating sole-proprietorships with debt amounts between $50,001 and $100,000.

There has been no change to operating businesses with regard to trust fund tax liabilities.